(…and why they’re terrible excuses)

We get it. Cyber insurance isn’t glamorous. It’s not like insuring a Ferrari or a diamond ring. But in 2025, cybercrime is costing UK businesses billions, and still some people find reasons to shrug it off. So let’s look at the top 7 excuses we hear for not buying cyber cover — and why each one could end up costing far more than the premium.

1. “It’ll never happen to us.”

Right — because hackers only target the big names, right? Wrong.

Marks & Spencer, Harrods, The Co-op, and even Jaguar Land Rover have all been hit in 2025. If they can be taken down, your business Wi-Fi password “Password123” probably isn’t saving you.

2. “It’s too expensive.”

So are ransomware payments, legal fees, and hiring a PR firm to explain to your customers why their data is now for sale on the dark web.

JLR lost millions when a hack halted production. Insurance premiums look like pocket money compared to that.

3. “We’ve got great IT guys.

And we bet they’re brilliant. But no human can patch every vulnerability, stop every phishing email, and fight off every cyber-criminal gang across the globe.

Even the Co-op and Harrods — with world-class teams — got hit. If the big boys can’t stop everything, neither can Dave in IT (sorry, Dave).

4. “We’ve already got insurance.”

Yes, but your property policy won’t cover a hacker in Moscow encrypting your files. Your liability policy won’t pay for forensic experts. Cyber insurance is designed for the 21st-century risks that traditional policies simply don’t touch.

5. “We can just pay the ransom.”

Good luck with that. There’s no guarantee the criminals will give you the key — and even if they do, you’ll still face business downtime, reputational damage, and possibly an FCA fine for letting it happen.

Plus, funding international crime isn’t exactly a great business strategy.

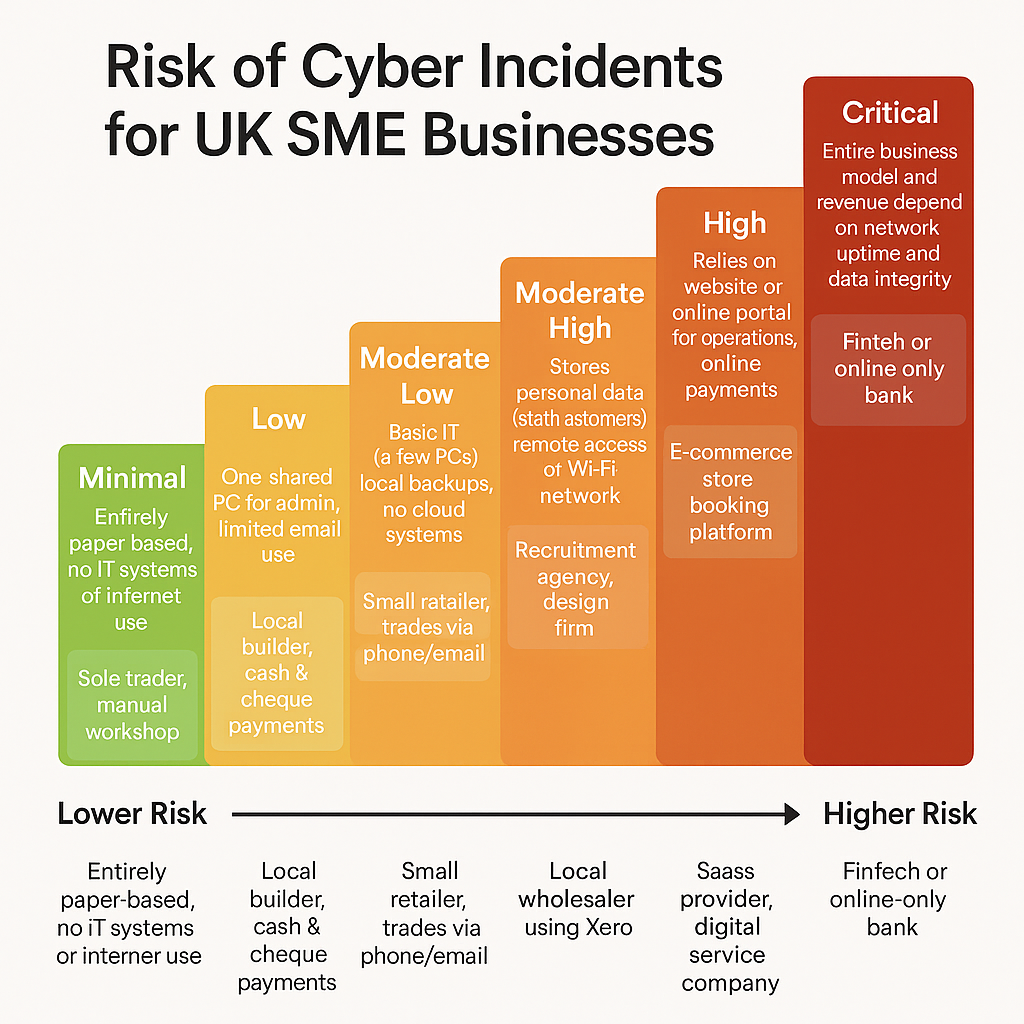

6. “Our business isn’t big enough to be a target.”

Hackers love small businesses because they’re easier prey. A ransomware gang doesn’t need you to be the next M&S — they just need you to panic, pay up, and move on. Small firms are now more likely to be targeted because of weaker defences.

7. “We’ll deal with it if it happens.”

That’s like refusing to buy car insurance because you’ll “sort it out after the crash.” Spoiler: you won’t. Without insurance, you’ll be sorting it out with your own chequebook, while your competitors scoop up your customers.

The Punchline

All of these excuses sound reasonable — until you’re the one facing angry customers, regulatory fines, and a week-long shutdown.

Cyber insurance won’t stop attacks happening (no insurance policy ever does), but it will give you the resources to recover fast: expert incident response teams, legal support, PR management, and of course, financial protection.

Take Cyber Risk Seriously

2025 has already shown us what happens when businesses get complacent. From high street retailers to car manufacturers, no one is immune.

So the real question isn’t “Should we buy cyber insurance?”

It’s “Can we really afford not to?”

Talk to us today on 01706 824023 about protecting your business. We can provide you with insightful risk management information and the right cyber insurance.